Tel: +8615857575756

Mob: +86-573-82710863

Email: henrymiao@jxyinmao.com

Add: Suyin International Building, No.999 Hongxing Road, Jiaxing, Zhejiang, China

Dec 6, 2021

Beginning in late November, textile raw material factories have greatly reduced their prices during promotion, and the enthusiasm of some weaving companies for stocking has also been ignited.

On November 15th, the raw material discount was nearly RMB 600. The average production and sales of polyester factories on that day were close to 200%, and some factories exceeded 300%. It has returned to the price before the restrictions on electricity and production.

There is a saying in the textile market that when raw materials prices are rising, like “riding on a rocket” and when they are falling, just like “squeezing toothpaste”. This refers to the fact that the prices of raw materials are rising fast and falling slowly, and this time the price has dropped so much. , why?

1. Weak end-demand

In the past, in September and October the orders were affected by overseas "Christmas season" and domestic "Double Eleven" and "Double 12" orders, there would be order peaks. However, affected by high ocean freight and weak domestic demand, orders in September of this year were relatively bleak, while orders in October declined a lot due to restrictions on electricity and production. Now Double Eleven has passed, export orders are also delayed due to the approaching Christmas, orders will be placed after Christmas.

2. Increased demand for liquidity

Although the current inventory of polyester factories is not very high, since late October, the electricity curtailment measures in Shandong, Henan, Jiangsu, and other provinces have been relaxed and canceled, and production capacity has been quickly restored and released. The accumulation rate of some small and medium-sized enterprises has continued to increase, and the working capital has been occupied.

At the same time, textile companies have increased their cash flow demand and need to pay for spare parts, utilities, wages, bonuses, loans, and interest when approaching the end of the year, some companies have adopted methods such as dumping inventories to maintain production. Plans for purchasing raw materials will become more cautious.

Therefore, Due to the uncertain order of textile companies, coupled with the rapid decline of raw materials, the market is expecting the decline of polyester. Polyester manufacturers have begun to promote large-scale sales in the face of the sluggish polyester production and sales and the declining cost end, and will also possibly start a weekly promotion model in the later period.

3. Increasing electricity tariffs also increase costs

Rising electricity prices directly increase the cost of weaving production, and corporate profits will be affected.

The area of Jiangsu and Zhejiang is a region with scarce power resources. The government often improves local power consumption by increasing electricity prices, restricting power usage, and peak-shifting power usage. As a result, many large and medium-sized weaving companies will spend more than RMB 10,000 in monthly electricity bills, and the increase in electricity bills for companies with high energy-consuming equipment will be even greater.

According to the information, in terms of textile mills, electricity bills are a high proportion of cost expenditures second only to raw materials. Especially for companies with a relatively high degree of automation, the cost of electricity is already higher than the labor remuneration expenditures of personnel. Take an example of a textile company with 840 water-jet and air-jet looms and an annual output of 70 million meters. The annual electricity bill is about RMB 4 to 5 million, and the company's labor expenditure is also RMB 3 to 4 million.

Although there are many textile companies in Jiangsu and Zhejiang, the local government still considers the allocation of electricity for other industries when the total power is insufficient.

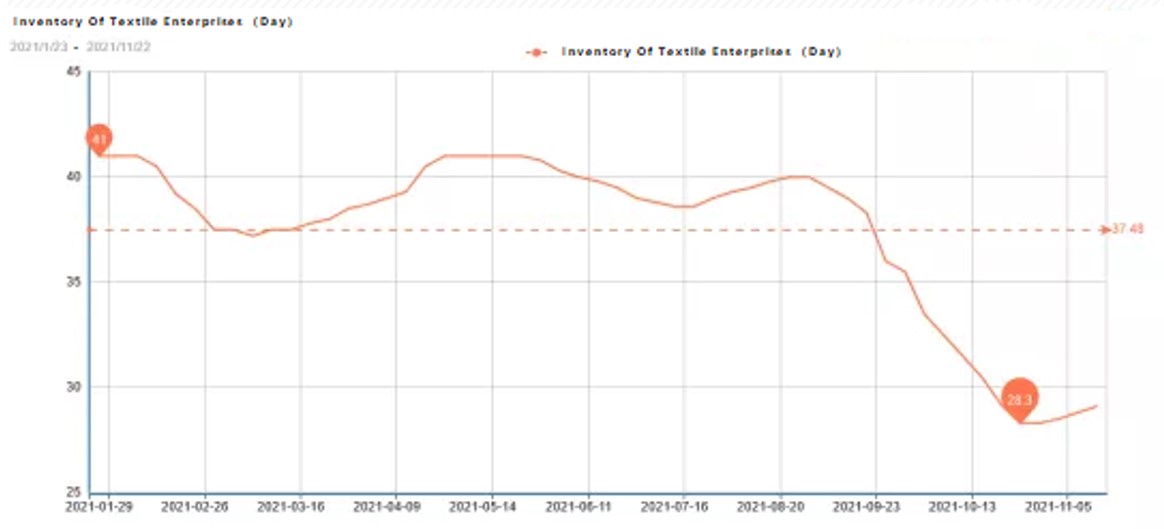

4. Market inventory is gradually increasing

From the perspective of the entire textile industry chain, the current polyester factory product inventory has accumulated, and POY has rebounded to medium inventory state of more than 20 days. With the decline of polyester products after the year, the depreciation of this part of the inventory is inevitable!

Reprinted from choudu.com

Tel: +8615857575756

Mob: +86-573-82710863

Email: henrymiao@jxyinmao.com

Add: Suyin International Building, No.999 Hongxing Road, Jiaxing, Zhejiang, China

We offer not only products, but also our after-sales service. Welcome to contact us to know more.